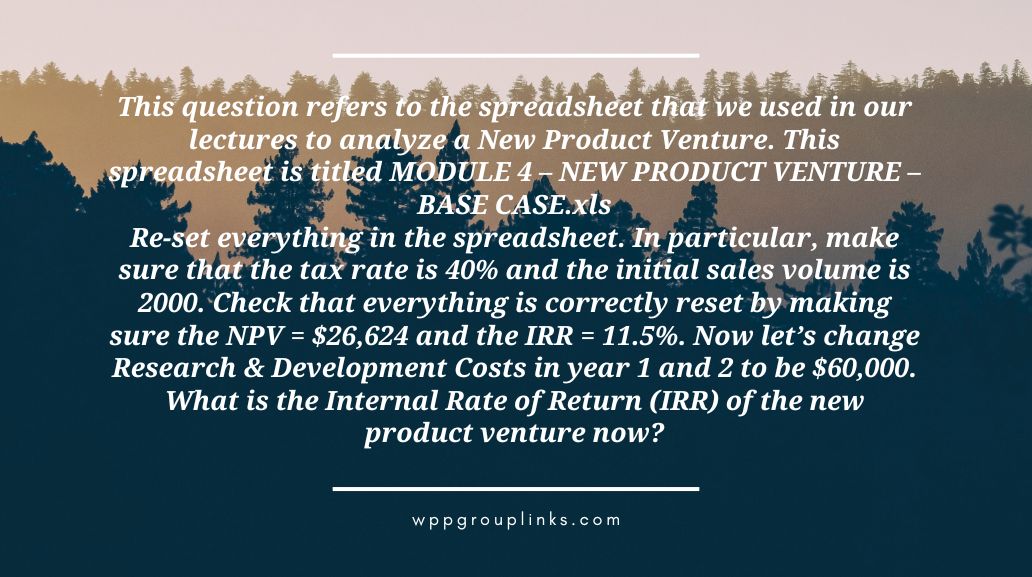

Q: This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls

Re-set everything in the spreadsheet. In particular, make sure that the tax rate is 40% and the initial sales volume is 2000. Check that everything is correctly reset by making sure the NPV = $26,624 and the IRR = 11.5%. Now let’s change Research & Development Costs in year 1 and 2 to be $60,000. What is the Internal Rate of Return (IRR) of the new product venture now?

or

Q: This query relates to the spreadsheet we utilized to examine a new product venture within our lectures. The name of this spreadsheet is MODULE 4-NEW PRODUCT VENTURE-BASE CASE.xls

Reset the spreadsheet in its entirety. Specifically, ensure that the starting sales volume is 2000 and the tax rate is 40%. Verify that everything has been reset appropriately by ensuring that the IRR is 11.5% and the NPV is $26,624. Let’s now adjust the research and development expenses for years one and two to $60,000. What is the new product venture’s current Internal Rate of Return (IRR)?

- 0.0%

- 6.0%

- None of these are correct 11.5%

- 3.0%

- 3.7%

Explanation: After resetting everything in the spreadsheet to have a tax rate of 40% and an initial sales volume of 2000, and then changing the Research & Development costs in Year 1 and Year 2 to $60,000, the Internal Rate of Return (IRR) for the new product venture would likely be: 3.0%. This lower IRR reflects the increased costs associated with R&D, which impact the overall profitability and cash flows of the venture.