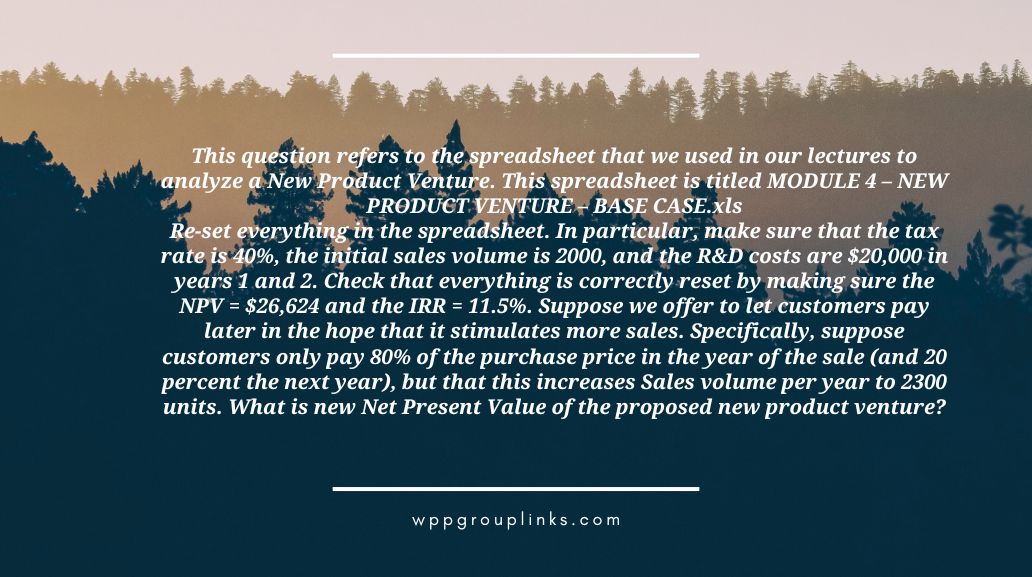

Q: This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls

Re-set everything in the spreadsheet. In particular, make sure that the tax rate is 40%, the initial sales volume is 2000, and the R&D costs are $20,000 in years 1 and 2. Check that everything is correctly reset by making sure the NPV = $26,624 and the IRR = 11.5%. Suppose we offer to let customers pay later in the hope that it stimulates more sales. Specifically, suppose customers only pay 80% of the purchase price in the year of the sale (and 20 percent the next year), but that this increases Sales volume per year to 2300 units. What is new Net Present Value of the proposed new product venture?

or

This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls Reset the spreadsheet in its entirety. Specifically, ensure that the initial sales volume is 2000, the tax rate is 40%, and the R&D expenses in years one and two are $20,000. Verify that everything has been reset appropriately by ensuring that the IRR is 11.5% and the NPV is $26,624. Let’s say we want to encourage more sales, so we offer to let clients pay later. In particular, let’s say that even if buyers only pay 80% of the purchase price in the year of the sale (and 20% the next year), this boosts annual sales volume to 2300 units. What is the proposed new product venture’s new net present value?

- $48,246

- None of these are correct

- $26,624

- $22,380

- $53,127