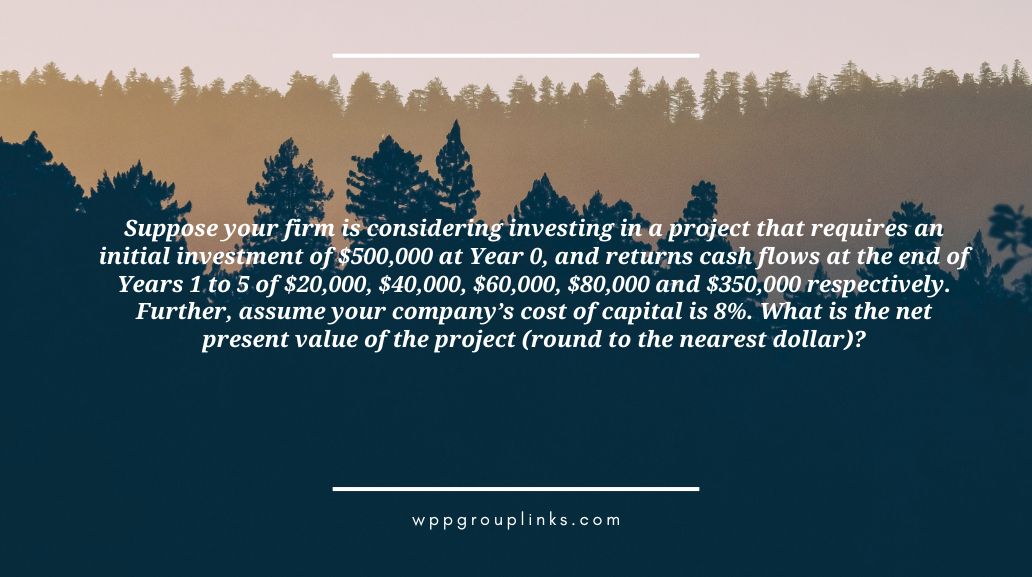

Q: Suppose your firm is considering investing in a project that requires an initial investment of $500,000 at Year 0, and returns cash flows at the end of Years 1 to 5 of $20,000, $40,000, $60,000, $80,000 and $350,000 respectively. Further, assume your company’s cost of capital is 8%. What is the net present value of the project (round to the nearest dollar)?

or

Q: Let’s say your company is thinking of funding a project that would yield cash flows of $20,000, $40,000, $60,000, $80,000, and $350,000 at the end of Years 1 through 5, with an initial investment of $500,000 in Year 0. Additionally, suppose that the cost of capital for your business is 8%. To the closest dollar, what is the project’s net present value?

- $0

- $90,000

- None of these are true

- -$25,552

- -$102,551