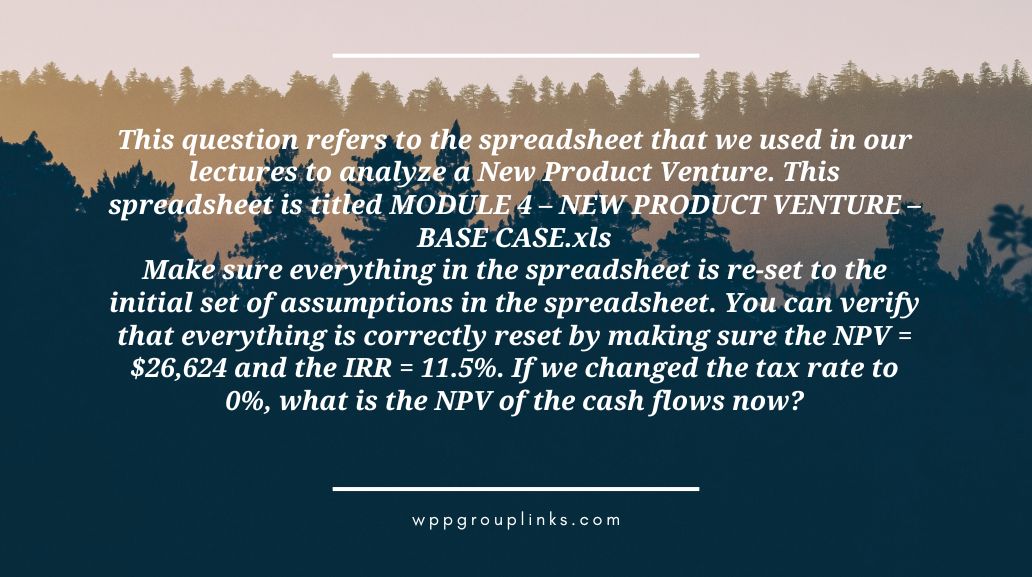

Q: This question refers to the spreadsheet that we used in our lectures to analyze a New Product Venture. This spreadsheet is titled MODULE 4 – NEW PRODUCT VENTURE – BASE CASE.xls

Make sure everything in the spreadsheet is re-set to the initial set of assumptions in the spreadsheet. You can verify that everything is correctly reset by making sure the NPV = $26,624 and the IRR = 11.5%. If we changed the tax rate to 0%, what is the NPV of the cash flows now?

or

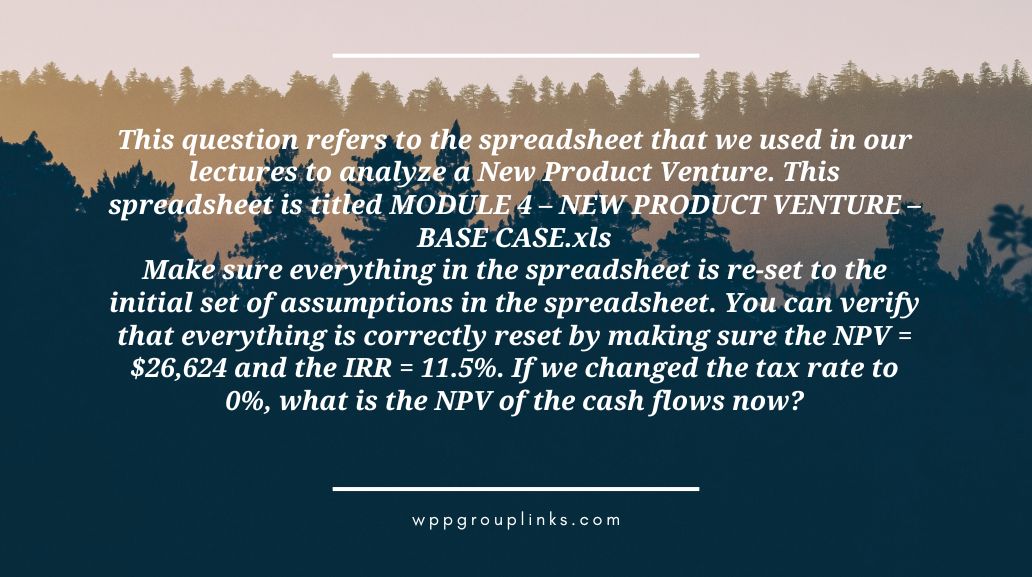

Q: This query relates to the spreadsheet we utilized to examine a new product venture within our lectures. The name of this file is MODULE 4-NEW PRODUCT VENTURE-BASE CASE.xls.

Verify that all of the spreadsheet’s assumptions have been restored to their original state. You may confirm that everything has been reset successfully by confirming that the IRR is 11.5% and the NPV is $26,624. What is the current net present value of the cash flows if the tax rate is set to zero percent?

- $26,624

- None of these are correct

- $54,676

- $0

- $124,676

Explanation: If the tax rate is changed to 0%, the NPV of the cash flows increases because the venture keeps all of its earnings without paying taxes. This raises the cash flows, leading to a higher NPV.